The pressing need to ship massive amounts of soybean byproduct overseas has led the Port of Grays Harbor to employ a tax tool yet to be used elsewhere in the county.

Should port commissioners approve it at a May 31 meeting, the port will become the first local government on Grays Harbor to create a tax increment financing area, which will help fund its largest-ever expansion, set to be completed in the next two years.

It’s thanks to a state law passed two years ago that relies on a simple idea: “growth should pay for growth,” according to port Finance Director Mike Folkers. And the Terminal 4 expansion project involves much growth — including $123 million just from private business Ag Processing, Inc., or AGP, a major soybean producer.

With tax increment financing, the port will take property taxes from that massive investment and use them to repay bonds sold to fund part of the $47 million public share of the project.

“The project should be able to pay for itself in that way, and that’s what TIF takes advantage of,” Folkers said.

A bean and a bill

AGP, a company based in the Midwest, has been shipping soymeal from the Port of Grays Harbor for two decades, said Kayla Dunlap, the port’s director of government and public affairs. The company grows soybeans, then crushes them, creating two products: oil and meal, or flecks of the bean.

Soybean oil can be used to make renewable diesel, a valuable resource in the push to decarbonize fuels. AGP has ramped up soybean processing to meet screaming demand.

But the more soybeans you squish, the more meal you get. It, too, needs to go somewhere.

The Port of Grays Harbor is the closest mainland port to Asia, where the market for meal is the most profitable. Aberdeen, the ideal place to sail soymeal across the Pacific, will see twice as much of the product passing through, by rail, in the next two years.

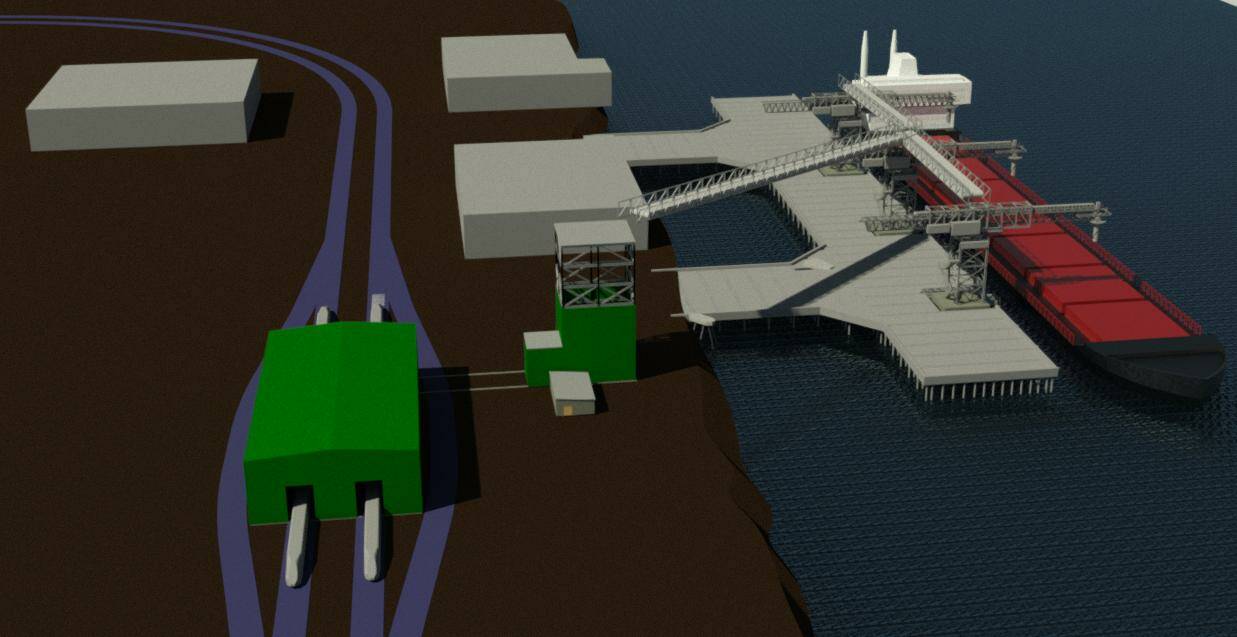

On its property lining the Chehalis River, the port will construct 10 miles of new railroad, refurbish a cargo area and modernize its aging dock, all for $47 million. AGP will build a towering ship loader for delivering soymeal directly from trains to boats. Those upgrades together make up the Terminal 4 Expansion and Redevelopment Project.

Over half of the port’s funding share will come from a $25 million federal grant. Along with some state Legislature funding, the port will cough up $3 million of its own cash, and a sliver of the funding will come from Grays Harbor County. That left a $10 million hole to fill.

“We don’t have funds lying around, $10 million extra bucks to do this,” Folkers said.

A change to state law in 2021 presented an opportunity.

When Washington passed a “TIF for jobs” bill in 2021, it became the 49th state in the nation to allow TIF financing. Tax increment financing was created in the 1950s in California and spread across the country.

The bill expanded on several other, similar programs — all labeled along the lines of “community revitalization” — aimed to spur investment in a particular area by funding public infrastructure there. The bill gives three types of local government — cities, counties and ports — the power to use TIFs by their own authority.

So far, several cities have used it to fund public road projects. In 2021 the Port of Pasco set up a TIF for a $500 million milk processing facility, and the Port of Vancouver USA is using the bill to finance the replacement of its 100-year-old Terminal 1 dock.

Setting up a TIF

The first step is to pick a geographic area. The proposed TIF area for the port is a 15-acre section of port property smack dab above Terminal 4. Because the port, as a public-body, is tax exempt, the land currently generates zero dollars of property tax for local districts it lies within — the city of Aberdeen, Timberland Library, Grays Harbor County, Grays Harbor Hospital, and several state school levies.

Right now, the proposed area contains nothing but pavement. But that will change dramatically over the next several years, when, if all goes to plan, AGP will construct the entirety of its $123 million infrastructure inside those 15 acres.

AGP will then begin to pay property taxes on its expensive new soymeal machine, even though the port will retain ownership of the land itself.

The key is creating the TIF area before construction begins.

If commissioners approve a TIF area on Wednesday, it would “freeze” property tax values within the area starting January 1, 2024. From that point on, for a period of 25 years, all new property taxes paid from infrastructure improvements — within the TIF area only — would go directly to the port, instead of the local taxing districts that currently surround Terminal 4. The state school levies are exempt from the TIF area.

In total, the levy rate of the TIF area is $3.91 per $1,000 of assessed value. A city of Aberdeen levy makes up about half of that, and Grays Harbor County levy makes up another quarter.

With that total levy rate, the TIF area will have accumulated nearly $16 million in tax revenue at the end of 25 years — the total “increment.” That will be enough to pay back $10 million in bonds sold in the near future.

TIF funds can only be used to pay for the Terminal 4 project, Folkers said.

Then, in 2048, the TIF area would sunset, and local districts would resume collecting property tax based on those future values. If property values and revenues reach the $10 million mark sooner than anticipated, the TIF would sunset early.

According to Folkers, property value of AGP’s $123 million investment is projected to grow to nearly $250 million by the mid century mark, meaning those local districts would add a quarter billion dollars to their tax base when that time rolls around.

In the meantime, though, the 15 acres will continue to generate zero property tax revenue for those local districts, missing out on dollars that would otherwise, without the TIF, be flowing to basic services.

With AGP’s current operation at the port, the company already pays large amounts of property taxes to local districts.

TIFs can sometimes be controversial. In other states, citizens’ and policy groups have criticized TIFs — usually of much larger scale — of gentrifying cities by concentrating development to particular areas.

But without the TIF, an essential piece to funding the port’s side of the project, AGP wouldn’t be investing in the area at all, Folkers said, meaning those taxing districts wouldn’t be collecting revenue anyway.

“There’s a massive private investment here, but if we don’t make the public investment, they’re not coming,” Folkers said.

Folkers said the port fully informed officials of each local government within the TIF area, and, given the significant economic upside for Grays Harbor, didn’t receive much objection or concern. The port also held several public hearings on the subject in April and May.

The Terminal 4 expansion will create 80 new jobs, workers required to maintain operations, Folkers said. That doesn’t include construction jobs or other jobs created by subsequent economic development in the area.

“We think it makes sense on the merits,” Folkers added. “We think it’s good for Grays Harbor. It’s jobs, it’s investment.”

The timing of the May 31 commissioner’s meeting is critical, Folkers said. By law, local governments must decide on a TIF area by June 1 for it to take effect the following year. If the port’s TIF area isn’t created by the start of next year, it would have to wait until 2025, by which point about $60 million of AGP’s investment would be in the rearview, the port unable to divert those property taxes.

Contact reporter Clayton Franke at 406-552-3917 or clayton.franke@thedailyworld.com.

*This story has been corrected to state that the Port of Vancouver USA is using tax increment financing to pay for the replacement of its Terminal 1 dock, not a new public market, as originally published.