U.S. Rep. Derek Kilmer (WA-06), Mike Kelly (PA-16), Gwen Moore (WI-04), and John Moolenaar (MI-02) introduced the Tribal Adoption Parity Act, a bipartisan bill aimed at establishing parity between state and Tribal governments in determining whether an adoption qualifies as “special needs” and is thus eligible for the full adoption tax credit. U.S. Senators Amy Klobuchar (MN) and John Hoeven (ND) previously introduced companion legislation in the Senate, according to a news releae.

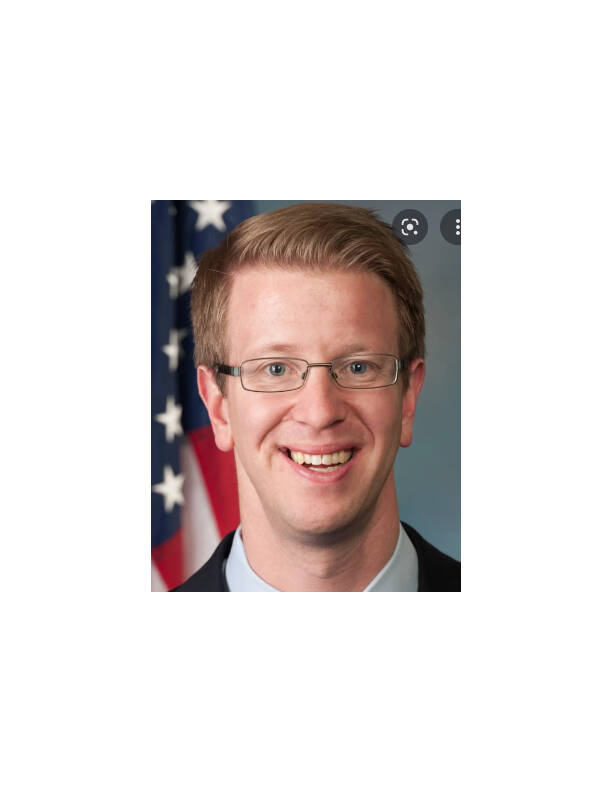

“The Tribal Adoption Parity Act is a common sense, bipartisan measure that aims to ensure that a family adopting a child through Tribal courts receives equal access to the adoption tax credit,” said Rep. Kilmer. “Simply put, that’s about fairness to Tribal communities and it’s about providing critical support for children with special needs. Congress should get this done.”

Currently, taxpayers can receive an adoption tax credit of up to $14,300 to help offset the costs of adopting a child. If a child is considered to have “special needs,” meaning they are difficult to place in a home for various reasons (such as being older, having a disability or health condition, or being part of a sibling group), adoptive parents are automatically eligible for the full tax credit. However, only state governments can currently determine if a child has special needs, excluding Tribal governments and making it more challenging for parents who adopt through Tribal courts to receive the full tax credit.

The bill amends the Internal Revenue Code of 1986 to recognize Indian Tribal governments for the purposes of determining whether a child has special needs under the adoption credit. This change will help ensure that families adopting through Tribal courts have access to the same financial support as those adopting through state systems.

The Tribal Adoption Parity Act is endorsed by the National Congress of American Indians and National Indian Child Welfare Association.

“The Tribal Adoption Parity Act will rectify an inadvertent oversight in tax law by recognizing the ability of American Indian and Alaska Native Tribal governments, who already have the authority to arrange and sanction adoptions for their children, to determine which of their member children are “special needs” for the purpose of the adoption tax credit,” said Sarah Kastelic, executive director of the National Indian Child Welfare Association. “Qualified families that adopted children through Tribal courts could file for the current child tax credit. The National Indian Child Welfare Association strongly supports this bill and its recognition of Tribal sovereign authority.”

“The National Congress of American Indians is proud to support the Tribal Adoption Parity Act,” said Larry Wright, Jr., executive director of the National Congress of American Indians. “This piece of legislation puts Tribal Nations on a more equal footing with states and, in cases where it applies, it will help ensure a smooth and successful transition for children and their parents. NCAI urges Congress to pass this piece of legislation for our Native children.”