The Aberdeen School District will hold a special election in February to ask voters to approve a bonding measure for up to $46.8 million to build a new Stevens Elementary School. On the same ballot will be a $3.2 million levy request to continue the existing tax that funds programs and operations that aren’t paid for by state funding, including music, athletics, technology and curriculum.

The district expects to receive about $5 million in state construction funds toward Stevens and has been awarded a $3 million grant from the Federal Emergency Management Agency (FEMA) to build a vertical evacuation tower in the event of a tsunami or other natural disaster. Additional funding sources are being explored.

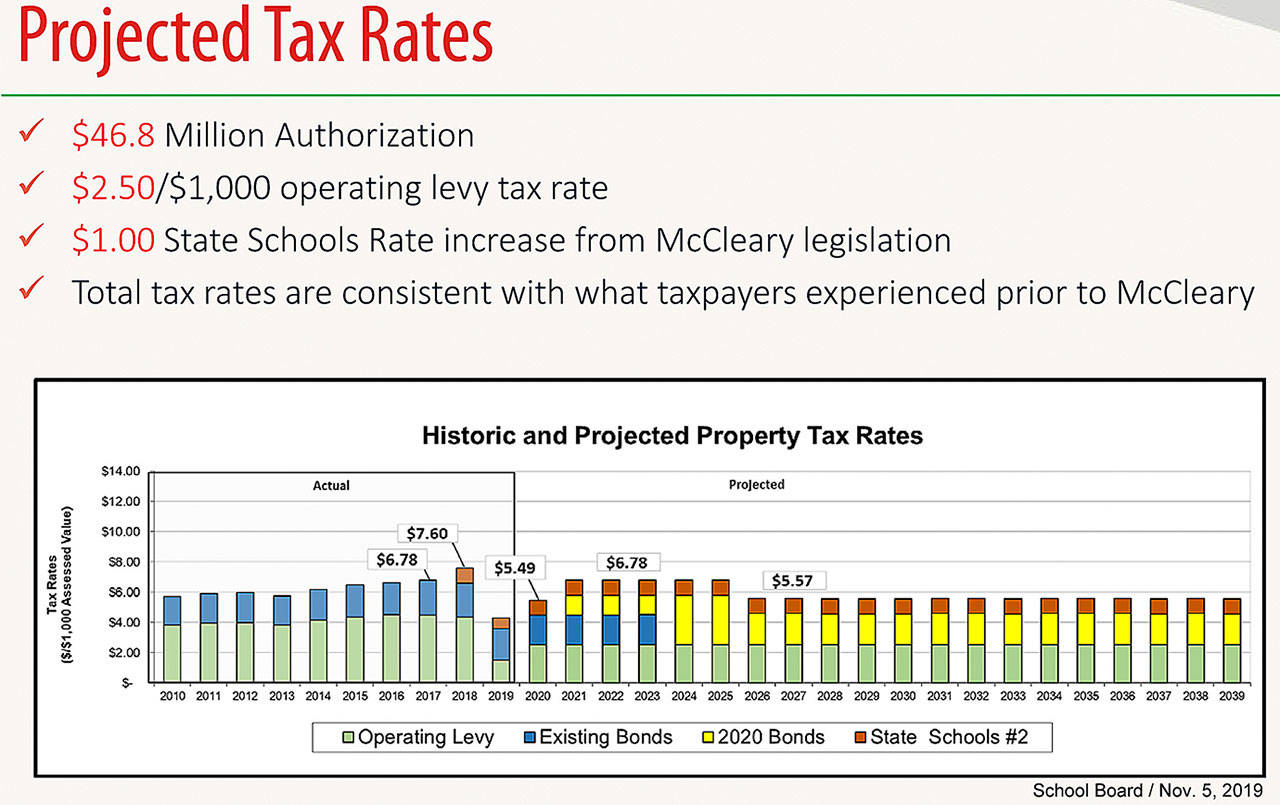

“These important investments are structured so that taxpayers will not see an increase above 2017 rates,” Superintendent Alicia Henderson said. “The enrichment levy is critical for day-to-day operations. And now, with the bonds for Aberdeen High School due to be paid off by 2024, it is time to keep the promise that Stevens School is next.”

The school board unanimously agreed to bring the measures before the voters after months of study.

The enrichment levy is due to expire in 2020 and voters are being asked to extend it for four years at the current rate of $2.50 per $1,000 of assessed property valuation.

Henderson explained that establishing the levy for the next four years, instead of the usual two years, is intended to provide certainty about tax rates at a time when the district is also requesting authority to build a new school.

“Aberdeen voters have supported this levy for many years,” said Henderson. “As we prepare to build a new school, the board wanted our community to have the assurance that we are not planning to ask for an increase in the enrichment levy.”

The bond proposal for a new Stevens Elementary School seeks authority to sell up to $46.8 million in bonds. The current school dates to 1951, and hasn’t seen significant modernization since the 1970s, according to the district.

“We recognize that the price for a new grade school is significant,” said Henderson. “But we have done our due diligence, and must comply with state requirements for new school construction. We also recognize our community’s desire to build a school that will keep our children safe in the event of a tsunami or other disaster.”

The bond sale will be scheduled so that payments are interest-only until the high school is paid off, according to the schedule presented to the board. The total combined tax rate – local bonds, local levy and the state schools tax – is projected to equal the 2017 rate of $6.78 per $1,000 of assessed value through 2025, after which it will decrease to $5.57 per $1,000 of assessed value.