Do you have a hard time making both ends meet and require immediate cash? In most cases, having a poor credit score can make it tough to locate a lender that is willing to give you a no credit check loan.

However, there’s no need to worry—we have good news for you. Our team has extensively researched the American market and identified the most exceptional lenders that offer no credit check loans.

These loans help you cover unexpected expenses and financial shortfalls. As such, they serve as reliable financial aid for emergencies and assist between pay periods. Read on to get more insight on them.

Top US No Credit Check Loan Lenders

- Credit Clock – Longer loan repayment periods.

- Honest Loans – Large lending amounts.

- Fast Loans Group – Low lending rates.

- Fast Money Source – Best no credit check loans.

- Big Bucks Loans – Fast loan approvals.

- Heart Paydays – Guaranteed loan approvals.

- Low Credit Finance – Convenient loans.

The lenders we have listed above are excellent options for obtaining no credit check personal loans in the US. They quickly provide the financial assistance you need, subject to meeting their approval criteria.

Below is a breakdown of each lender’s distinctive features to help you make an informed decision that best suits your financial needs and capabilities. Keep reading to gain a better understanding of what each lender offers.

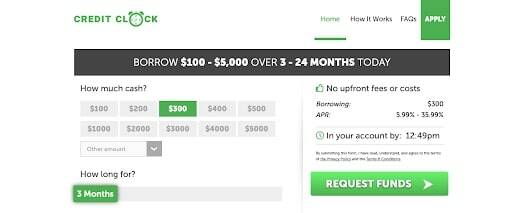

Credit Clock: Longer loan repayment periods

Credit Clock is a top selection for borrowers with bad credit and no credit history looking to obtain no credit check loans in the US in 2025. The company is best known for its longer repayment periods, which give the borrower ample time to repay the loan. The loan amounts start from $100 to $5,000. This amount range ensures that you meet your financial needs. On top of that, no extra charges or costs are added to the loan.

Below are some of the benefits of using Credit Clock as your preferred lender:

- Flexible repayment periods of up to 24 months.

- Fast approval processes.

- Flexible lending amounts.

- Reputable lenders.

- Soft credit checks.

- No hidden charges or costs.

Credit Clock ensures that you get your loans in time through same-day approvals, helping your financials meet your needs.

Honest Loans: Large lending amounts

Honest Loans is a reliable broker who will lend you a no credit check loan to help you finance your cash deficit in the US. Honest Loans has a swift application process that takes a few minutes to complete, and their loans take longer to approve and disburse. Their lending amounts start from as little as $100 to a maximum of $50,000. With that lending amount and fast approvals, you can meet all your obligations in time.

Some of the benefits that are to be enjoyed with Honest Loans as your lender include:

- Large lending amounts of up to $50,000.

- Fast decisions.

- Variety of loans.

- Low-interest rates.

- Convenient application.

- No extra fees.

- Zero credit checks.

With Honest Loans, you have a friendly interface that will enable you to get your no credit check loan amounts with just a few clicks and shorter waiting periods.

Fast Loans Group: Low lending rates

Fast Loans Group is a loan broker with a wide berth of connections to enable you to have a vast choice for your preferred lender. With Fast Loans, you can easily get a no credit check loan of amounts between $100 and $50,000.

Fast Loans Group also boasts low lending rates, which enables you to access loans at a cheaper cost. The following are reasons why Fast Loans Group is a good consideration for your no credit check loan:

- Easy to apply.

- State-of-the-art data encryption.

- Fast approvals.

- Same-day funding.

- Easy application process.

- No credit checks.

- Flexible borrowing repayment options.

Fast Loans Group is a company that does its best to ensure that all the borrowers’ financial needs are met in time while still upholding the integrity of their data and information.

Fast Money Source: Best no credit check loans

Fast Money Source is a broker that grants no credit check loans in the US. If you have pending bills that were left out or an emergency, Fast Money Source should be your go-to remedy provider. This is because it accepts and advances loans to borrowers regardless of their credit score and credit history. It has lending amounts between $100 and $50,000. With Fast Money Source, you can be assured of fair treatment courtesy of it being a part of the Online Lenders Alliance (OLA).

Below are reasons why Fast Money Source should be your best choice for acquiring a no credit check loan in the US in 2025:

- Regulated lending.

- No upfront costs.

- Long repayment periods.

- Safe and secure data encryption.

- User-friendly interface.

- Easy to follow applications.

- No credit checks.

Fast Money Source ensures that all its clients are treated fairly and with utmost integrity, regardless of their credit history. With Fast Money Source, you can be sure that all your financial troubles are whisked away.

Big Bucks Loans: Fast loan approvals

Big Bucks Loans is a viable option for getting access to a no credit check loan in the US. With Big Bucks Loans, you are guaranteed loan amounts that range between $100 and $5,000, regardless of your credit history. This is in addition to the positive impact it has on your credit file and a high approval rate that sees 9 out of 10 borrowers approved. With Big Bucks Loans, you can meet your cash deficit in just 15 minutes, courtesy of their fast payout.

The following are reasons why Big Bucks Loans is a good alternative no credit check loan lenders:

- They accommodate all credit scores.

- High approval rate.

- No credit file impact.

- Friendly borrowing rates.

- No credit checks.

- Minimum lending requirements.

- Easy application.

Big Bucks Loans is a credible broker for no credit check loans and should be put into consideration when applying for such loans.

Heart Paydays: Guaranteed loan approvals

Heart Paydays is a no credit check loan broker that has guaranteed approval loans for individuals with poor credit scores. With Heart Paydays, you are guaranteed loan amounts between $100 and $5,000 that have a long repayment period that could go up to 24 months. This allows for the meeting of one’s immediate obligations and ample repayment periods.

You get the following benefits when you get a no credit check loan using Heart Paydays:

- Flexible repayment terms.

- Easy application process.

- Low-interest rates.

- No lender discrimination.

- No credit checks.

- Fast lending decisions.

Heart Paydays extends no credit check loans to many individuals with bad credit and as a result, it should be a broker to consider when in need of financial assistance.

Low Credit Finance: Convenient loans

If you are looking for a no credit check loan lender who does not consider credit background, Low Credit Finance is the broker of choice. Low Credit Finance offers loan amounts of up to $5,000 that can be borrowed for as long as one needs it. With Low Credit Finance, all credit score types are welcome, and they can make instant decisions that translate to cash disbursement in barely 60 minutes.

These are some of the benefits of having Low Credit Finance as your broker for getting a no credit check loan:

- Flexible repayment terms.

- Low-interest rates.

- Easy application process.

- Plenty of lending alternatives.

- No paperwork involved.

- Flexible lending amounts.

- No hidden fees.

Low Credit Finance specializes in lending out to individuals with poor credit scores and as such, it is a convenient broker for no credit check loans.

What Is a No Credit Check Loan?

A no credit check loan is a type of loan that does not require the lender to perform credit checks on the borrower. As such, credit history and credit score are not important factors to consider when approving such loans. This fact makes no credit check loans a suitable borrowing option for individuals who have poor credit scores or bad credit histories and have no chance of being granted loans by financial institutions.

These loans do not require any security as collateral and are usually accompanied by interest rates that are relatively higher than those offered by conventional financial institutions. Therefore, it is highly advised that you thoroughly examine the fees, rates, and terms before taking them.

What Are the Examples of No Credit Check Loans

Several types of loans can be extended to borrowers without having hard credit checks performed. They include:

- Payday loans – These are short-term loans that are taken to be repaid on the borrower’s next payday. They are taken in small amounts that could range from a few hundred dollars to a few thousand dollars and are meant to cover unexpected expenses before payday.

- Car title loans – These are secured loans that use the vehicle as collateral. The lenders of car title loans tend to hold onto the title of the vehicle until the loan is paid back in full. It is key to note that they have high-interest rates and fees.

- Cash advance – A cash advance is a type of short-term loan that allows you to borrow money against your future paycheck. Cash advances can be obtained through your credit card or a payday lender.

- No credit check installment loans – An installment loan is a type of loan that is repaid over time through a series of scheduled payments or, better yet, installments. They can be used for various purposes, such as home repairs, medical bills, or car purchases, and are available through a variety of lenders.

- Personal lines of credit – A personal line of credit is a flexible borrowing option that allows you to access funds as needed, up to a predetermined credit limit. These are similar to credit cards, but instead of a revolving credit limit, you are given a line of credit that you can draw from as needed.

What to Look at to Get the Best No Credit Check Loan

When obtaining a no credit check loan, there are important aspects that must be considered to ensure you not only get the best lenders and offers but also make an informed decision. Some of those factors include:

- Interest rates – The interest rate, being the amount that the lender charges on the loan has to be compared between various lenders to ensure that you get the lowest rates available.

- Fees – It is important to read carefully the terms of the loans and understand all the fees associated with the loan before agreeing to it. These fees may include origination fees and late repayment fees among others.

- Online reviews – It is of the essence to take a sneak peek at the online reviews of the possible lenders to have a glimpse of what previous borrowers have to say. This will give you an idea of the lender’s reputation and customer service.

- Licensing – Laws regarding no credit check loans are not similar in all states. As such, it is important to ensure that the lender you choose is licensed to operate in your state and is compliant with all state laws. Licensed lenders tend to follow the regulations on fee limits, interest rates, and loan terms.

- Terms – Understand the loan terms and conditions, such as the repayment period, payment frequency, and any penalties for early or late repayment. Ensure that the terms are favorable and suit your financial needs.

Alternatives to No Credit Check Loans

When you need quick cash, you may consider getting a no credit check loan. However, it is important to note that there are several alternatives to no credit check loans. Here are some options, especially if you have a good credit score:

- Personal loans – If you have a good credit score, you may be able to qualify for a personal loan from a bank, credit union, or online lender. Personal loans typically have lower interest rates than no credit check loans and may have more flexible repayment terms.

- Co-signer loans – Getting a co-signer with good credit to apply for a loan gives you a higher chance of approval and getting a favorable interest rate. However, it is important to repay the loan on time to improve your credit and avoid leaving the co-signer responsible for the payments.

- Credit unions – Unlike banks, credit unions offer loans at lower interest rates than most traditional lenders. They often provide flexible repayment terms and lower fees.

- Secured loans – Secured loans require collateral, such as a car or property, to secure the loan. They have lower interest rates than unsecured loans as the collateral reduces the risks associated.

- Bad credit loan lenders – These are lenders who are specifically designed for borrowers with poor credit scores. These lenders offer loans with higher interest rates and fees, but they are more willing to lend a helping hand if you have a low credit score.

Eligibility Criteria for No Credit Check Loans

Even though no credit checks are performed for no credit check loans, there are several other background checks that lenders perform to ensure eligibility. They are:

- A US citizenship.

- Be at least 18 years of age.

- A verifiable source of income.

- An active bank account.

- Functional contact details.

The above qualifications are easily met by a fair share of applicants and as a result, high approval rates are attributed to no credit check loans.

In addition, the application processes are easy to follow, and the cash payouts are almost instantaneous, as they are instantly approved.

Frequently Asked Questions

Do I have to visit a physical store to apply for a no credit check loan?

No, most lenders offering no credit check loans have online applications. You can apply for the loan online and receive the funds directly deposited to your bank account.

How much can I borrow?

The amount you can borrow depends on the lender’s policies. The maximum amount you can get from a no credit check loan is $50,000.

Do I have to pay fees?

Not necessarily. Most lenders do not charge prior or extra fees for loans. Nonetheless, some charge application fees, processing fees, and late payment fees. The fees vary by lender, and you should review the terms and conditions carefully before accepting a loan offer.

Are no credit check loans a good idea?

No credit check loans are a good option for people with bad credit or no credit history who need quick cash. However, it is vital to ensure that you can adhere to the loan’s terms and policies.

What happens if I miss a loan repayment?

If you miss a loan repayment for a no credit check loan, you will likely face additional fees and interest charges. In addition, your credit score may be negatively impacted, making it harder for you to obtain credit in the future. Some lenders may also report late payments to credit bureaus, which can lower your credit score. It’s important to contact your lender as soon as possible if you think you may miss a payment and work out a plan to avoid any negative consequences.