When you’re in dire need of cash, and your credit score is alarmingly low, traditional financial institutions may not be your best bet. The chances of securing a loan from them can be disappointingly slim.

But worry not. We’ve curated a list of companies that specialize in offering subprime loans, specifically designed to help individuals with bad or no credit history bridge their financial gap.

Explore our recommended subprime loan brokers, where fast approvals are the norm and credit checks are kept to a minimum or even nonexistent.

Best Subprime Loan Lenders in the US in 2025

- Fast Money Source – Best subprime loan lenders

- Fast Loans Group – No credit checks for subprime loans

- Honest Loans – Large subprime loan lending amounts

- Credit Clock – Flexible subprime loan lending

- Big Buck Loans – No credit file impact

- Low Credit Finance – The most flexible subprime loan options and terms

- Heart Paydays – Guaranteed instant subprime loans

You can easily secure a subprime loan from any of these brokers by clicking on the respective link and following the simple application process.

If you want more information to help you settle on the best lender, keep reading for a detailed review of each.

Fast Money Source: Best subprime loan lenders

Fast Money Source is one of the leading brokers in the US that facilitates the connection between lenders and borrowers of subprime loans. It provides a platform for individuals who need cash urgently but cannot get loans elsewhere because of non-prime credit scores (credit scores below 600).

Fast Money Source has a wide variety of loans that extend to those who need them most. With them, you are guaranteed subprime loans of up to $50,000. Their flexible loan range comes in handy as you can easily sort out your immediate financial needs.

Fast Money has the following advantages as a broker company for subprime loans:

- Fast approval of subprime loans.

- Low-interest rates.

- All credit scores are welcome.

- Fast disbursement of approved funds.

- Easy subprime loan application process.

- Convenient online application.

Fast Money Source will match you with the best direct lender, who will approve your subprime loan as quickly as possible so that you can meet your unforeseen expenditures.

Fast Loans Group: No credit checks for subprime loans

Fast Loans Group stands out as another top lender in the realm of subprime loans. What sets them apart is their disregard for credit scores when processing loan applications. Thanks to this inclusive approach, anyone can apply for a subprime loan on their platform without worrying about their credit history.

Moreover, Fast Loans Group offers low interest rates on their subprime loans, ensuring that borrowers are not burdened with exorbitant repayment amounts. This allows you to manage your finances more comfortably.

In addition to their favorable lending terms, Fast Loans Group boasts swift approvals, meaning you can swiftly secure cash amounts of up to $50,000.

- Fast decisions.

- Easy submission of information.

- It has prioritized the safety and privacy of the information submitted.

- Easy subprime loan application.

- A variety of subprime loans to choose from.

- No queuing or visiting physical offices to get subprime loans.

Fast Loans should be among the primary options for anyone looking to get a subprime loan from online lenders.

Honest Loans: Large subprime loan lending amounts

Are you looking for a subprime loan but have nowhere else to turn? Well, look no further—Honest Loans has your back. Honest Loans is a subprime loan broker that will ensure you get loan amounts between $100 and $50,000 by the next day after approval.

Honest Loans does not perform any credit checks on the borrowers. This increases your chances of getting a loan approved by one of the many lenders that they have a connection to. With friendly interest rates, you can be sure that the repayment amount will not be inflated.

Below are the features of Honest Loans that make it a premium alternative for getting subprime loans:

- Fast subprime loan approvals.

- User-friendly interface that makes it easy to apply.

- Convenient online applications.

- Supportive customer care team.

- Low APR.

- No extra fees or charges.

- Flexible lending options.

Honest Loans ranks highly on the list of our recommended brokers. They have the most competitive loan rates in the game, which is a good consideration when applying for a subprime loan.

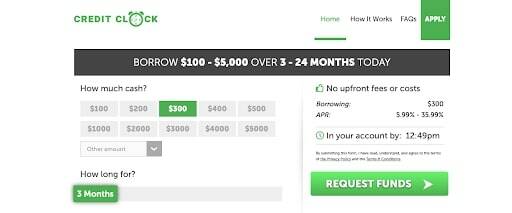

Credit Clock: Flexible subprime loan lending

Credit Clock is the go-to lender for subprime loans if you have been denied loans by financial institutions. It has flexible repayment options and terms that allow borrowers to make repayments as per agreements. With such, you do not have to worry when you are not able to make your payment.

In addition, Credit Clock has a good maximum lending amount of $5,000. Credit Clock also does not perform credit checks, so low-credit individuals are guaranteed to get financial help in terms of subprime loans.

Here is why Credit Clock should be at the top of your list if you are looking for a subprime loan:

- Flexible lending options.

- Versatile repayment terms.

- Low-interest rates.

- Instant subprime loan approval.

- Bad credit scores are allowed.

- Quick funding.

- They offer a variety of subprime loans

If you need quick access to cash to resolve an emergency, Credit Clock is an optimal choice for a subprime loan.

Big Bucks Loans: No credit file impact

If you’re turning to Big Bucks Loans for help, it’s likely that your credit history has seen better days. The great news is that Big Bucks Loans doesn’t take your credit file or score into account when approving loans. This makes them an excellent option for obtaining subprime loans.

In addition to offering low-interest loans, Big Bucks Loans provides subprime loans of up to $5,000. What’s more, your borrowing from Big Bucks Loans won’t leave any marks on your credit file.

Big Bucks Loans has the following advantages when it comes to subprime loan lending:

- FICO scores are not considered.

- Fast approvals of about 15 minutes.

- High approval rates for subprime loans.

- No Credit checks.

- No credit footprint on your credit file.

- An easy application process that takes a few minutes.

For the best subprime loans and the best lending rates, Big Bucks Loans is the place to look.

Low Credit Finance: Flexible subprime loan options

If you’re seeking a subprime loan with a flexible repayment schedule, look no further than Low Credit Finance. This company specializes in providing subprime loans to individuals with bad credit scores, allowing you to access funds even in challenging financial situations. With a cap of $5,000, you can repay the loan at your own pace, depending on the specific terms set by the direct lender.

Once your subprime loan application is approved, Low Credit Finance ensures quick access to funds. You can receive your desired amount in as little as 60 minutes. This rapid processing time enables you to address unforeseen expenses promptly.

When you choose Low Credit Finance for your subprime loan, you gain the following benefits as a borrower:

- All credit types are allowed.

- Same-day funding.

- Flexible repayment terms that are suitable.

- Friendly borrower rates.

- Easy online application.

- No hidden fees or charges.

- A vast network of subprime loan lenders.

Low Credit Finance has a wide connection of lenders who are willing to approve and disburse your subprime loan as fast as possible so they are a reliable company.

Heart Paydays: Guaranteed instant subprime loans

Heart Paydays is another highly recommended lender for guaranteed subprime loans. Heart Paydays grants subprime loans to individuals of all credit types without discrimination. It offers subprime loans between $100 and $5,000 with suitable repayment periods, which could be anywhere between 3 and 24 months.

With Heart Paydays, you are sure that the requested amount will be made available for your use as soon as approval is made. Additional perks include:

- Instant subprime loan approvals.

- Low-interest rates.

- Lengthy repayment periods.

- A wide selection of loans to choose from.

- An excellent customer care team.

- Easy online application.

For lenders who do not discriminate when approving subprime loans, Heart Paydays is the ultimate selection.

What is a Subprime Loan?

A subprime loan is a loan that is granted to borrowers who have extremely low creditworthiness and high-risk profiles. This is often attributed to limited credit history, poor credit scores, or past financial difficulties. However low your creditworthiness is, for you to be classified as a subprime loan borrower, your credit score has to be below 600.

Subprime loans have higher interest rates and fees than conventional loans. This is due to the high risk associated with lending to subprime individuals.

Despite the higher costs compared to conventional loans, subprime loans serve as a financial alternative that offers help to those facing credit and financial challenges. Subprime loans come in various forms, such as mortgages, auto loans, and personal loans, among others, that will be discussed below.

Origins of Subprime Lending

The history of subprime loans can be traced back to the early 20th century when lenders began offering loans to borrowers with less-than-perfect credit scores. These loans were often accompanied by higher interest rates to compensate for the increased risk. Over time, subprime lending expanded, particularly in the housing market. This growth was in line with the emergence of specialized lenders focusing on borrowers with lower credit scores.

In the 2000s, subprime lending experienced significant growth, driven by relaxed lending standards and the packaging of subprime mortgages into complex financial products. However, when the housing bubble burst in 2007/2008, the subsequent financial crisis revealed several vulnerabilities within the subprime lending market.

Widespread defaults on subprime mortgages triggered a domino effect, leading to a severe global economic downturn and prompting regulatory reforms to address predatory lending and risky lending practices. Since then, subprime lending has been subject to increased scrutiny and tighter regulations to mitigate the potential risks associated with it.

Types of Subprime Loans

As mentioned earlier, subprime loans come in different forms. Here are some of the subprime loans in existence and the purposes they serve:

- Subprime mortgages – Subprime mortgages are home loans offered to borrowers with or less-than-ideal financial profiles. It is worthwhile to note that subprime mortgages were key players in the 2007/2008 financial crisis when defaults on these loans led to widespread economic turmoil.

- Subprime auto loans – Subprime auto loans are loans extended to borrowers with low credit scores who are looking to finance a vehicle purchase. Subprime auto loans provide an option for individuals with credit challenges to access financing for a car purchase.

- Subprime personal loans – Subprime personal loans are unsecured loans provided to borrowers with lower credit scores or limited credit history. These loans serve various purposes, such as debt consolidation, medical expenses, or home improvements.

- Subprime credit cards – Subprime credit cards are specifically tailored for individuals with lower credit scores who may have difficulty obtaining traditional credit cards. These cards often have lower credit limits and higher interest rates compared to standard credit cards. Subprime credit cards serve as a means for borrowers to rebuild or establish credit, but they must be managed responsibly to avoid further financial challenges.

- Payday loans – Payday loans are short-term loans offered to borrowers with limited income or poor credit. These loans are intended to provide quick cash advances until the borrower’s next payday but often come with exorbitant interest rates and fees. Over their existence, payday loans have drawn a lot of criticism for the cycle of debt they can trap borrowers in.

As can be observed from the above descriptions, subprime loans have more or less similar features and are categorized according to the purpose they are taken to serve.

Who Qualifies for Subprime Loans?

Over time, subprime loans have gained traction, given that they suit quite a diverse group of people, including:

- Individuals with low credit scores – Borrowers with low credit scores can turn to subprime loans as they might struggle to qualify for prime loans offered by traditional lenders. Based on the fact that these borrowers have experienced some form of financial challenges in the past or have limited credit history, having their loans approved is always seen as high risk, and most lenders don’t want to involve themselves in such risky lending practices.

- Individuals with limited credit history – Borrowers who have a limited credit history, such as young adults or recent immigrants, face difficulties in accessing traditional loans mostly due to their background or insufficient history to back their applications. Subprime loans can provide them with an opportunity to establish credit and access financing despite their limited credit profiles.

- Borrowers with past financial difficulties – Individuals who have faced financial setbacks, such as bankruptcy or foreclosure, find it challenging to qualify for prime loans. Subprime loans are much easier to access, and these individuals can opt for them.

- Self-employed workers – Self-employed borrowers often face the challenge of inconsistent income flows. This necessitates borrowing to cover the times when income is not enough to meet all expenses. Also, as meeting the income verification requirements of prime loans poses a threat to their approvals, subprime loans can offer them more flexibility in terms of income documentation, allowing them to access the financing they need when they need it most.

- Low-income borrowers – Subprime loans are often utilized by borrowers with low incomes who struggle to meet the debt-to-income ratio requirements of prime loans. These borrowers heavily rely on subprime loans for various purposes, including personal expenses.

Tips On How to Manage Subprime Loans

Managing debt is usually one of the ways that you can implement to achieve the financial freedom you desire. As such, the following are tips on how you can manage your subprime loans to enable you to achieve financial stability:

- Create a budget – By developing a comprehensive budget that outlines your income and expenses, you can get a clear picture of your financial situation. This will help you allocate funds accordingly and thus eliminate the need for or manage subprime loans.

- Make timely payments – It is essential to pay your bills and debts on time to avoid late fees and penalties. As late payments for subprime loans may negatively impact your credit score, you could consider setting up automatic payments or creating reminders to ensure you don’t miss any due dates.

- Cut expenses and increase income – Look for areas where you can cut expenses and redirect those savings towards debt repayment. Additionally, you should consider exploring ways to increase your income, such as taking on a part-time job or freelancing, to accelerate paying off subprime loans.

- Seek professional advice – If you’re overwhelmed by subprime loan debts, you ought to consider seeking guidance from a credit counseling agency or a financial advisor, as they can provide personalized strategies and help you navigate your specific debt challenges.

- Practice self-discipline and patience – As managing subprime loan debt requires discipline and patience, it is recommended that you stay committed to your debt repayment plan and celebrate the small milestones you may achieve along the way. Always remember that managing debt is a long-term process that requires consistent effort.

Conclusion

As we conclude this piece, we take note that subprime loans play a significant role in providing credit access to individuals with lower credit scores, limited credit history, or past financial difficulties. While they serve as a financial lifeline for many borrowers, it’s nonetheless essential to recognize the associated risks and costs.

Luckily, the lessons learned from the 2008 financial crisis have led to increased regulation and oversight in the subprime lending market. These measures aim to protect borrowers from predatory practices and promote responsible lending.

As borrowers, it is crucial to consider the terms and repayment ability before committing to a subprime loan. Additionally, by taking proactive steps to improve creditworthiness and explore alternative financing options, you can help yourself navigate the subprime lending landscape with caution and make informed decisions.

Frequently Asked Questions

What is the difference between subprime loans and prime loans?

The main difference lies in the creditworthiness of the borrowers. Prime loans are offered to borrowers with good credit scores and strong credit history, while subprime loans are extended to borrowers with lower credit scores or limited credit history.

Why do people choose subprime loans?

Individuals choose subprime loans when they have difficulty qualifying for prime loans due to their credit situation. Subprime loans provide an opportunity for borrowers to access credit and meet their financial needs when other options may not be available.

What are the risks associated with subprime loans?

Subprime loans generally carry higher interest rates and fees compared to prime loans. Borrowers may face a higher likelihood of default, which can lead to financial challenges and damage to their credit scores. Additionally, there is a higher potential for one to enter into a cycle of unending debt.

Are there alternatives to subprime loans?

Yes, there are alternatives to subprime loans. Borrowers can consider secured loans, credit union loans, peer-to-peer lending, or personal loans from family and friends. Building credit, increasing income, and exploring financial counseling services are also viable alternatives.

How does the history of subprime loans impact current lending practices?

The history of subprime loans, particularly the 2008 financial crisis, has prompted tighter regulations and increased scrutiny in the lending industry. Lenders now adhere to stricter underwriting standards, and consumer protection laws have been implemented to prevent predatory lending practices and ensure responsible lending.

What should borrowers consider before applying for a subprime loan?

Before applying for a subprime loan, borrowers should carefully consider the terms, interest rates, and fees associated with the loan. They should assess their ability to repay the loan and explore alternative options to ensure they make an informed decision that aligns with their financial goals.